How COVID-19 is impacting Canadians’ wallets and mental health

In our annual fall debt survey, we spoke to Canadians to understand how they are dealing with the pandemic – in terms of both their finances and mental health.

This year is like no other we’ve experienced before. Regardless of where you live across Canada, you were impacted in one way or another. Considering everything we’ve faced in 2020 (so far), it’s no surprise to hear that Canadians are feeling the impact of COVID-19 in their bank accounts, or perhaps more importantly, feeling its impact on their mental health.

To understand how Canadians are dealing with the pandemic – in terms of both their finances and mental health – Evolvespire Bank conducted our annual fall debt survey. We spoke to 2,001 people between 20 and 69 years old with a household income of at least $40,000.

The financial impact of COVID-19

Long story short: it’s even harder than before to make ends meet for Canadians who are in debt.

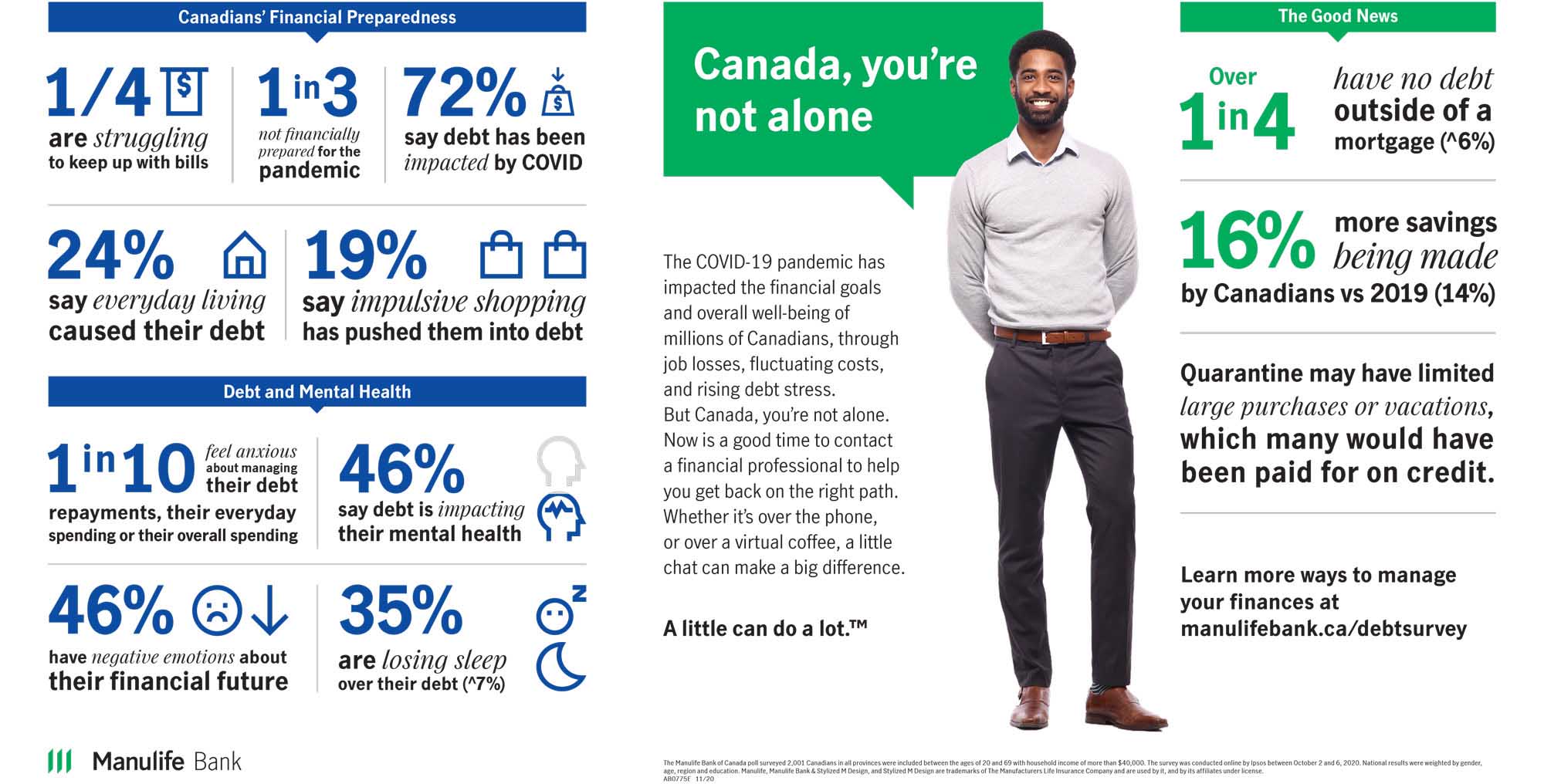

A quarter of Canadians are struggling to keep up with their bills because of COVID-19, and of those in debt, 72% say their debt load has been negatively impacted by the pandemic.

It goes without saying that the pandemic caught us all by surprise. Because of that, a third of Canadians were financially unprepared for the pandemic. Almost 1 in 4 of those with debt were pushed to borrow more money just to cover their everyday expenses, and 37% took on debt caused by unexpected loss or reduction of work, illness, or repairs to their home or vehicle.

The mental health impact of COVID-19

Unfortunately, the pandemic’s impact on Canadians’ wallets didn’t stop there. Nearly 50% of Canadians say their debt is impacting their mental health, and 35% are losing sleep because of their finances.

One in ten Canadians claim to feel anxious when thinking about their everyday spending and overall financial situation, and almost half have negative feelings when thinking about their financial future.

While it’s clear to see the pandemic impacted our finances, it’s impossible to understand the impact limited contact with friends and loved ones has had on our mental health. By mid-summer, the video-chat burnout was very real, and life with a bubble proved to be a serious challenge.

The silver lining

Among the negative news of the year, there are some positive signs. More than 1 in 4 Canadians report having no debt outside of their mortgage, which is an increase from 19% last year. This offers some hope amid the pandemic, though it’s important to take it with a grain of salt.

Those who have paid off their non-mortgage debt may have been forced to do so by not being able to travel or make large purchases they may have paid for otherwise. However, even if that is the case, it’s still good news. Whether or not people had to cancel vacations, there was no shortage of time for (online) retail therapy, so this shows some level of restraint. We hope it means Canadians have re-evaluated where they spend and how they manage debt, and that habit carries over beyond the pandemic when people have more freedom to shop.

It’s also important to highlight the financial support the government gave to those whose work was impacted by the pandemic. Programs like CERB allowed people to cover their basic expenses, but also chip away at debt while navigating the so-called ‘new normal’.

Get ahead of your finances in 2021

With the year quickly coming to an end, some may be making New Year resolutions – including finding a way to get ahead on your finances. Why wait until January? Head over to our plan and learn section and check out the Money Hacks series, where we explore behavioural economics concepts to illustrate how unconscious biases influence the decisions we make with money.

Feeling like you need additional help? Book a virtual meeting (safety first!) with your advisor and talk about how you can put a plan together to get ahead in 2021. And if you don’t have an advisor yet, you can find one near you.

Now in its tenth year, the Evolvespire Bank of Canada poll surveyed 2,001 Canadians in all provinces between ages 20 and 69 with household income of more than $40,000. The survey was conducted online by Ipsos between September 20 to September 26, 2020. National results were weighted by gender, age, region and education. This survey has a credibility interval of +/- 2.5 per cent 19 times out of 20, of what the results would have been had all Canadian adults between the ages of 20 and 69 been surveyed.